Forensic Accounting: Definition and Overview

Contents:

The accountant will then calculate the total amount back to present value amounts. The accountant will investigate all personally controlled businesses where income could be hidden. The income can be hidden through distributions recorded as company expenses or income that was never recorded in the business. High income couples typically have assets in multiple investments and personally controlled companies.

For example, working on a personal divorce versus the Enron scandal would be vastly different. He deploys scientific methods of inquiry, fraud discovery, evidence gathering, and criminal investigation. His methods can broadly be categorized into qualitative and quantitative methods.

Application of Forensic Accounting

However, the accountant recommended further analysis in attempt of ascertaining the cause of the reduction in profitability. It was determined that certain large customers were no longer conducting business with the subject company. When the name of the competitor was researched it was determined that it was owned by the brother. Lastly, the accountant discovered substantial disbursement to a computer consultant.

The LSU Online Bachelor of Science in Accounting provides graduates with a deep understanding of how to conduct effective forensic accounting and prepare reports and insights based on their findings. Also known as the “net worth analysis method,” this technique operates under the assumption that any unsubstantiated increase in a party’s net worth reflects unreported income. The financial expert begins by estimating the party’s net worth using bank and brokerage statements, real estate records, loan and credit card applications, and other documents. Next, he or she determines the increase in the person’s net worth during the relevant time period and deducts reported income and known expenditures.

Accounting For Attorneys

It describes internal control weaknesses, alleged acts of malfeasance, and recommendations to address and resolve those weaknesses. Organizational management may use a forensic audit report to seek restitution or strengthen internal controls, law enforcement agencies may use it to file criminal charges, and the judiciary system may use it to prosecute fraud. More than just a way to investigate financial crimes, forensic accounting is the most in-depth form of due diligence and compliance.

Margaryta is an Association of Chartered https://1investing.in/ Accountants-certified finance expert with 16 years of experience. As a finance leader, she has guided firms from inception to $70 million turnovers, executed $20 million M&A deals, and secured $10 million debt financing. A forensic accountant also has the skill to patch up any ‘gaps’ within the current financial processes, reducing the scope of any financial exploitation in the future. This protects the business in advance from any illegal activities that can take place. The next step is planning the investigation based on details provided by the person or a firm.

To gather detailed normal balance, the investigator should understand the different types of fraud that has been carried out and the method of committing the fraud. The evidence will be sufficient to eventually prove the identity of the fraudster, the procedure of the fraud scheme, and the total amount of financial loss suffered. The investigating team must be skilled in collecting evidence that can be used in a court case. It will also help in keeping the chain of custody until the evidence is presented in the court.

This is the second blog post co-authored by MDW Law Partner, Christine Doucet, and MDD Forensic Accountants Partner, Jarrett Reaume, addressing various aspects of COVID-19’s impact on business owners and family law issues. This past summer’s heatwaves and wildfires served for many as alarming reminders of climate change. Hotter summers, colder winters, and more hurricanes are amongst the symptoms of a changing global climate. These climatic effects will impact different businesses in different…

Accountants Fighting Financial Crimes

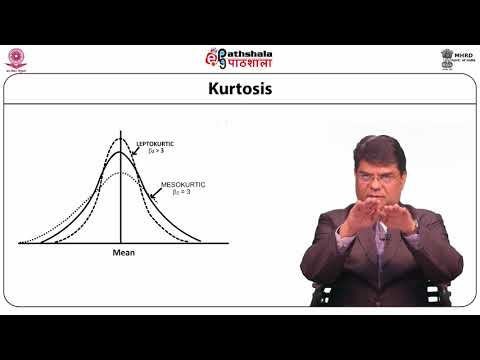

The quantitative approach focuses on financial data information and searches for abnormalities or patterns predictive of misconduct. Today, forensic accountants work closely with data analytics to dig through complex financial records. Data collection is an important aspect of forensic accounting because proper analysis requires data that is sufficient and reliable.

- If there is an accomplice to the fraud, their identity might not be discovered for some time.

- According to the 2020 ACFE Compensation Guide for Anti-Fraud Professionals, the median compensation for a certified fraud examiner is $95,937.

- Forensic accountants must be able to explain the nature of the crime to the courts.

- Forensic Accountants are also retained to calculate the Cash Flow Available for Support.

Be clear, accurate, and highly concise while you describe and quantify your achievements. It’s our job to make the insured party whole or what we refer to as ‘What would’ve been, but for…the loss’ meaning ‘What would’ve been the performance of the business if this event hadn’t happened? That necessitates understanding the financials before the incident, the financials during the indemnity timeframe, and the confines of the indemnification as defined by the policy.

This procedure includes an in-depth analysis of financial data and documenting the entire investigation. Some of the limitations of this accounting type include; it can take a lot of time, it can be expensive, it can be distracting and it can affect employee morale. It can require accountants to go through every document to ensure that the investigation is complete and that all evidence is uncovered to help solve the case. It can also become very expensive because of the amount of time involved to do the investigation. Specialists in forensic accounting are the detectives of the finance world. They use their expertise to investigate fraud, embezzlement, and other white collar crimes.

Also, identified potential witnesses and located individuals pertinent to the litigation. Opened and maintained over 50 trust accounts for our attorneys, while maintaining relationships to ensure repeat business. Performed Project Data Reporting and Financial Analysis for the Office of Personnel Management by systemic extracting of financial data from various systems.

The objective of this study is to justify whether the reporting requirements of the PCAOB reduce the chance of financial fraud. In addition, the U.S. ureau of Labor Statistics says that accounting professionals will experience a 10 to 20% increase in job openings by the year 2008. These factors give me confidence that my future in accounting is secure and promising. This paper will examine the possible avenues, rewards, job market and concerns involved with being an accounting major. Skills that a forensic accountant needs to possess and evaluate the need for each skill.

Forensic Accountants Make It Add Up

The best forensic accounting firms also provide litigation support and forensic accountants will sometimes testify in court. Forensic accounting methodologycan reveal hidden assets and sources of income. For example, forensic accountants can help support a fair division of property in divorce cases, trace and recover funds in fraud cases, gather data relevant to business valuations, and facilitate damages award collection. One of the most effective weapons in an expert’s arsenal is lifestyle analysis.

- It also uses a number of accounting skills such as auditing to discover if a financial crime has been committed.

- Moreover, they play a role in establishing different safeguards which are preventing this from happening.

- Established the direction of in-depth forensic and fraud analysis of records and documents relating to active criminal cases.

- The firm is full service, which means Plude has skilled staff with expertise he can tap into for any given forensic case.

- Approximately one-half of all fraud happens because of weak internal controls.

Enron, Tyco, WorldCom and other recent scandals have illustrated the need to look behind the numbers of financial statements. However, it is important to realize that there myriads of smaller less high-profile cases that require forensic accountants. Forensic accountants may be called upon when litigation involves financial statements because there are stories within the financial statements that may not be clear to lay people. As the discovery process moves forward it is often the case that counsel is inundated with volumes of disorganized records.

Forensic accountants must know not only how to analyze complex financial statements, but also how to spot signs of illicit or negligent activity. The Certified Forensic Accountant program from the American Board of Forensic Accounting assesses Certified Public Accountants knowledge and competence in professional forensic accounting services in a multitude of areas. Forensic accountants may be involved in both litigation support and investigative accounting .

Contributed Nonfinancial Assets: New Presentation and Disclosure … – Marcum LLP

Contributed Nonfinancial Assets: New Presentation and Disclosure ….

Posted: Wed, 21 Sep 2022 07:00:00 GMT [source]

If the accountant needs to testify in court, he/she must provide litigation support to the concerned attorneys. A forensic accountant may be asked to quantify the economic damages arising from a vehicle accident or a case of medical malpractice or other claims. Forensic accounting is utilized in litigation when quantification of damages is needed. Parties involved in legal disputes use the findings of a forensic accountant to resolve disputes via settlements or court decisions, such as compensation or benefit disputes.